(DailyVibe.com) – Did you know that you can get big savings at the pharmacy cash register with Medicare OTC drug cards? Per the Consumer Healthcare Products Association, consumers made nearly 3 billion trips to retail locations to purchase OTC meds.

Are you one of the many millions of Americans who spend a significant amount of money on OTC meds like ibuprofen? If so, you may be able to reap savings each time you visit the pharmacy to make this type of purchase.

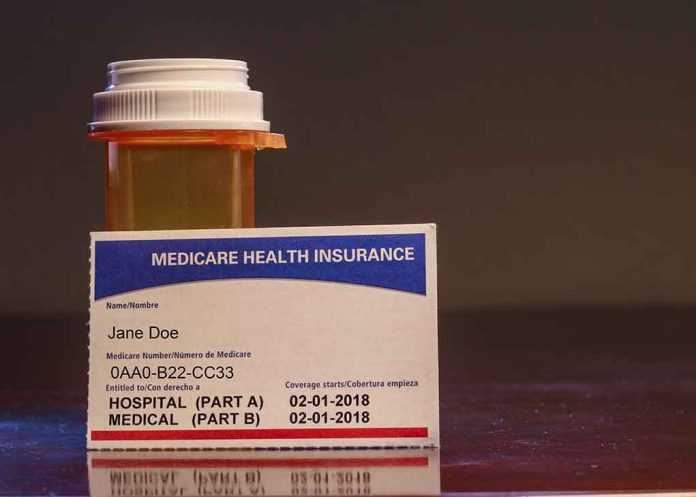

This is thanks to The Centers for Medicare and Medicaid Services, which have instituted the Medicare Advantage savings plan. This allows you to get assistance with OTC drug costs if you’re qualified. If saving money on your medication purchases sounds appealing to you, keep reading to learn more about the Medicare OTC drug card, how it works, and how to sign up for one of them.

How Can You Get a Medicare OTC Drug Card?

The primary purpose of Medicare is to cover health-related costs for Americans who struggle with affording them. However, it doesn’t help with over the counter drugs. That means if you’re on Medicare, you’re still on the hook for the nonprescription drugs you need from pharmacies.

The Medicare Advantage plan can help you with your OTC medication purchases, so you can get what you need without worrying about whether you can afford them. When you’re approved, you get an OTC drug card, and that card is your key to affording the cost of OTC medicines.

How to Activate Your Card and Check Its Balance

The OTC card is not active until you get it and activate it prior to making a purchase, similar to a credit card or a debit card. You’ll get instructions with your card, but your insurance provider can also help you. Always have the card at hand when you’re ready to activate.

To check your balance, call the number on the back of your OTC drug card or check your balance online. If this doesn’t work for you or if you have further questions, you can always all the customer service number for help.

The OTC Card: How Does It Work?

As soon as you activate your card, you can use the card to offset the OTC drug cost at pharmacies that participate. Most plans specify you “use it or lose it” with your plan, which means you have to use it before the end of the specified time period (usually the quarter), but it will help you afford medical supplies, cold medications, and more. When the plan expires for that quarter, your unused funds will go away and you will get your new balance.

If your card is empty at that time, you will have to wait for the card to get reloaded.

Common locations to use your card include these retail stores:

- Walmart

- CVS

- Dollar General

- Publix

- Family Dollar

- Walgreens

- Publix

- Target

The online pharmacies below may also accept your OTC drug card benefits:

- Planet Drugs Direct

- My OTC Store

- Health Warehouse

- Blink Health

Your plan will have a complete list of items that are eligible to be purchased with your Medicare Advantage OTC drug card benefits. These items often include:

- Vitamins

- Wellness Products

- Additional Health Products

- Pain Relievers

- Antibiotic Creams

- Durable Medical Equipment (DME)

- Wart Removal Products

- Band-Aids

- Cold Medications

- Sleep Aids

- General Medications

- Flu Medications

- Cough Medications

- Digestive Medications

- First-Aid Materials

- Denture-Related Products

Not every Medicare Advantage program offers Medicare OTC drug cards. This means it’s incredibly important to check which services and products your plan could include. If you spend a lot on OTC medications, consider the Medicare Advantage plan, and initiate a conversation with your insurance provider to see if you’re able to get this type of card.

Copyright 2023, DailyVibe.com